So, the stuff I said here and here about millages doesn't really apply to bond millages, which are different in a few ways.

First, when we approve a bond millages, we don't approve a millage rate (like "1.5 mills"), we approve a total amount of borrowing; see for example the ballot language for the 2020 AAPS bond:

Shall the Public Schools of the City of Ann Arbor, County of Washtenaw, Michigan, borrow the principal sum of not to exceed One Billion Dollars ($1,000,000,000) and issue its general obligation unlimited tax bonds for the purpose of defraying the cost of making the following improvements....

So they're basically asking to borrow up to a billion dollars, and future millage rates will be determined by whatever's required to pay back the loan. (The ballot language has some more details, in particular estimates of likely millage rates.)

I said before that new construction brings new property tax revenue, but that isn't the case for bond millages--the total revenue is determined by what's needed to pay back the bonds. So, new construction in the AAPS district just spreads those payments over more taxpayers, decreasing the millage rate a little.

Of course, new residents in the AAPS district may also require new school expenses, so may require new bonds. The decrease due to new taxpayers should approximately balance out the increase due to new bonds: when we add more students to a geographical area, the cost per student should stay about the same.

(Except, that's not quite true: for example, the more students you have in the same area, the more students you can serve with a single bus and a single bus route, so the cheaper busing is per student. So, there's probably a slight decline in per student costs as you increase the number of students. I wonder how much it is?)

Bond millages aren't subject to Headlee rollbacks, for obvious reasons--we don't want to default on the bonds.

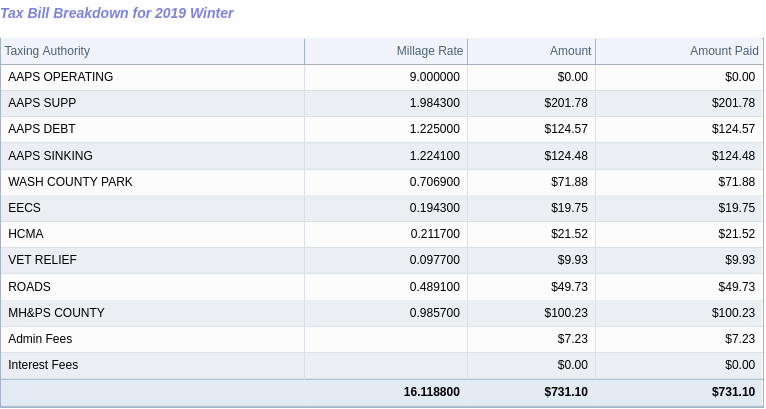

If you look up property tax information for a property in the property tax database, you can see an example of a bond millage on the "AAPS DEBT" line: